A dive on BNPL option on Blend

In this article, I'll give an overview of core BNPL metrics on Blend and take a deep dive on who the BNPL users are and how they utilize BNPL leverages to make yields or farm points.

Introduction

Buy Now, Pay Later (BNPL) option is nothing new in traditional business, but there's been a surge of interest over Blend's BNPL feature in the recent months.

How did the BNPL feature perform on Blend? Who are BNPL users? How did the whales behave? And most importantly, what can we learn from the metrics?

Let's take a dive 👇

TLDR;

Leverages and APRs are polarized in BNPL sales due to points incentive rules, and the median values may better reflect the leverage and APR adoptions.

Yuga collections and punks holders are more degen and likely to use leverages more aggressively.

BNPL buyers, lenders and borrowers are highly overlapped. Hardcore users contribute more transaction and volume share than their user share (20% vs 7%).

Whale domination is not overwhelming in BNPL sales. Retail and medium users also take a considerable share in both volume and transactions.

Whales tend to have safe leverages, basically under 6X.

What is BNPL?

Buy Now, Pay Later (BNPL) is an option on Blend, which allows traders to buy NFTs without bearing the full cost upfront. Borrowers can either acquire NFTs in full once they have the funds to repay the loan, or look to sell the asset if it appreciates, pocketing the difference. In a nutshell, BNPL provides a path for users to get exposure to bluechips even with a small amount of principals. That is to say, BNPL is a leveraging tool, where users can long/short collections with desirable leverages. If you are new to BNPL, grab a look at Defiant's report: https://thedefiant.io/blur-nft-lending

BNPL overall metrics

In two months post launch, there has been cumulatively 100725E volume through BNPL option, with 20852E principal and 79874E loan volume. The real time open loans volume on 12th, July also hits 872E volume with 174E principal and 699E loan volume. Really impressive work for a 2-month product!

BNPL leverages

The overall platform leverage seems to be relatively low. The average leverage for all BNPL sales is 4.83 and BNPL sales with open loans have an average leverage of 5.02. By going through loan status, it's clear that seized and auctioned loans have risky leverages, while open and repaid loans are more likely to have lower leverages.

In particular, during the NFT black weekends (1st and 2nd, Jul), most collections have open loans with lower leverages than those repaid, but now it seems like traders are increasing leverages.

Leverage distribution of BNPL loans is quite interesting. There’s a wide range of leverages among the BNPL loans. Despite some degen loans over 100X, most loans are below 5X. 2175 loans are located in 3X leverage, which is the favorite leverage tier for BNPL users.

Average and median leverage

Since average leverages may be distorted by the point system, average and median leverage are investigated and compared here. It can be easily seen that collections’ average leverage is much higher than the median leverage, suggesting leverages are not evenly distributed and may be polarized. Some oversized leverages can increase the averages. Under that circumstance, median leverages may better reveal the leverage adoption.

A bonus finding is that Yuga collections and punks tend to have super high leverages but low APRs. It appears to be contradictory, but makes sense that these degen farmers are hunting points aggressively.

BNPL APR

BNPL APR provides a good lens to observe BNPL user activities. The average APR of BNPL tradings is 0.75 and open loans' average APR is 0.67. Looks solid at first glance, right? But, the average can be deceiving sometimes. Let's find out more clues.

Most collections have over 0.4 average APRs, while their median APRs are 0, indicating APRs are highly polarized in the BNPL loans. Some loans have 0 APRs while others may have ultra high APRs, making average APRs still sizable.

In fact, the APR distribution reveals that around 58% loans are 0-apr.😲 A surprising share, uhhh…

For the non-0-apr loans, 2000 bps (20%) and 100000 bps (1000%) APRs are the most popular APR tiers. Given that 100000 bps APR is the final auction APR, 2000 bps APR is more likely the reasonable APR for the BNPL loans.

A fun fact is that the average APR on other lending platforms is 27% (kudos to ivan for the great dash). What a coincidence!

BNPL users

BNPL buyers, lenders and borrowers are involved in the BNPL sales. So far, there are 2480 buyers, 1256 lenders and 2095 borrowers using the BNPL option. But, are they all independent users?

Not really… The Venn chart says that there are 3495 total unique users of the BNPL option. Buyers and borrowers share over 75% of common users, while lenders are 70% independent.

What does it mean then?

There are not as many BNPL users as we think due to user overlap. They are still a small group of professional traders.

Buyers and borrowers have similar profiles and are more likely to utilize leverages to trade or farm.

~70% lenders are independent, meaning they trade less and are relatively more conservative.

The buyer-lender-borrower triple users are hardcore users of the BNPL option. The 261 hardcore fans (7% of user share) have contributed ~ 20% of loans and volume.

User leaderboards and whale activities

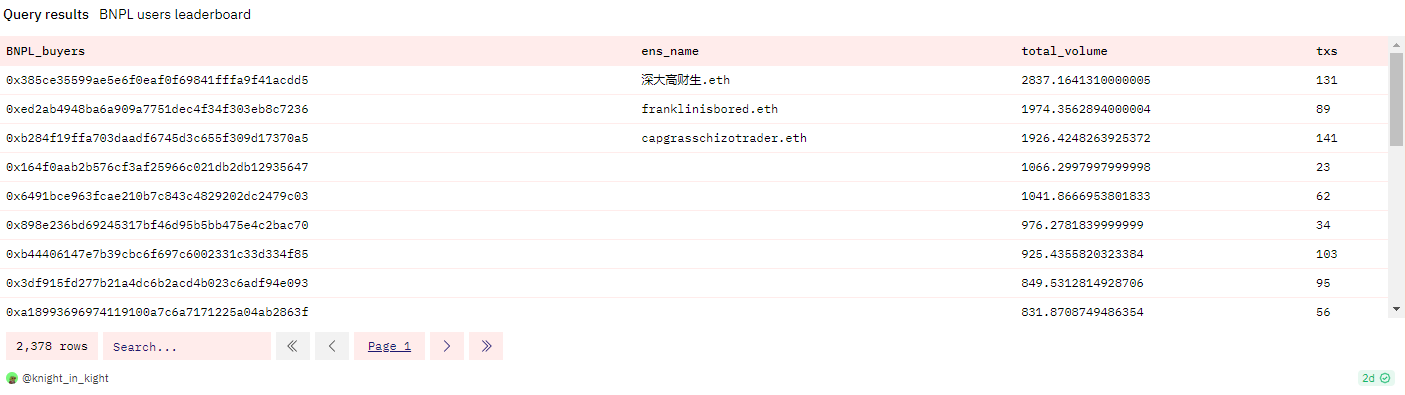

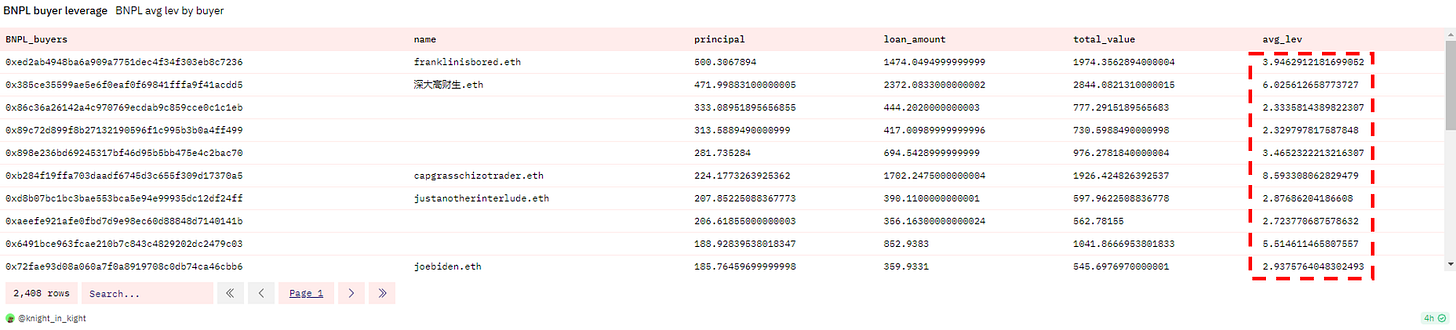

To find out who the whales are and what leverages they prefer, I’d love to take a dive on the user leaderboard. The leaderboard shows the top users who are actively utilizing the BNPL feature and are ranked by total volume.

There are some notable whales including 深大高财生.eth, franklinisbored.eth and capgrasschizotrader.eth, but their domination are not very overwhelming. Retail and medium users also take a considerable share in both volume and transactions.

Interestingly, whales are less degen than we think and tend to have safer leverages, basically under 6X.

The learnings

What can we learn from the BNPL metrics and chads? Here are a few takeaways:

Liquidity matters and pick up solid and liquid collections for loans. Therefore, when you refinance loans or auction NFTs, other traders are more likely to participate and take over.

Leverage is risky. Oversized leverages usually end up with super high interests or collateral liquidations.

Learn from whale traders and stay at a safe leverage(probably less than 5X) if you don't want to be liquidated.

Try to figure out your points and interest rewards. If points earning is little, other lending platforms also provide juicy APRs for NFT lendings.

Ending thoughts

The BNPL option is a great feature to maximize capital efficiency and offer users exposure to bluechips with small principal, but the cost is the high risks of being liquidated. We’ve already witnessed a bunch of BNPL users suffered losses when they abused lending leverages.

It turns out that whales are utilizing leverages with very caution, while crab/shrimp users tend to use more aggressive leverages. The BNPL users with different volume sizes behave quite differently in risk appetites.

On the other hand, though trading metrics of BNPL sales is eye-catching, a big share of BNPL users are point farmers, who are incentivized by points and future token rewards. What will they do after point incentives end? Does the party keep going on after the music being off?

Supplementation

How are leverages calculated?

Leverage = (principal + loan amount)/principal

What time is the data acquired?

Data as of 12/7/2023 on Dune Analytics

How to calculate the median leverage?

The median leverage is calculated by approx_percentile() function. The percentile of the distribution is 0.5 in this case.

Thanks for your reading here!

Please check more metrics on

: Buy Now Pay Later(BNPL) on BlendThis is NFA!!! DYOR if you want to invest⚠️

Share or like the blog will be appreciated and feel free to feedback on Twitter: @0x_knight📩