A post mortem of $ARKM airdrop

ArkhamIntel’s airdrop made a number of “users” rich overnight. But are the airdrop recipients target users of ArkhamIntel? This is a post mortem of $ARKM airdrop distribution and recipient behaviors.

Introduction

ArkhamIntel is a data analytics and tracking platform that allows users to easily monitor the on-chain activity of various blockchain entities. The platform is free to use and provides data or visualizations for various purposes, including informing trade decisions, trends prediction, risk managements and others.

After being listed on Binance launchpad, ArkhamIntel has started a massive airdrop to its early users.

How was the airdrop going? Who were the winners in the airdrop party? What did users do with their fresh tokens? And most importantly, what can we learn to better understand the airdrops?

Here's a post mortem👇 Don’t hesitate to grab a look!

Airdrop data dive

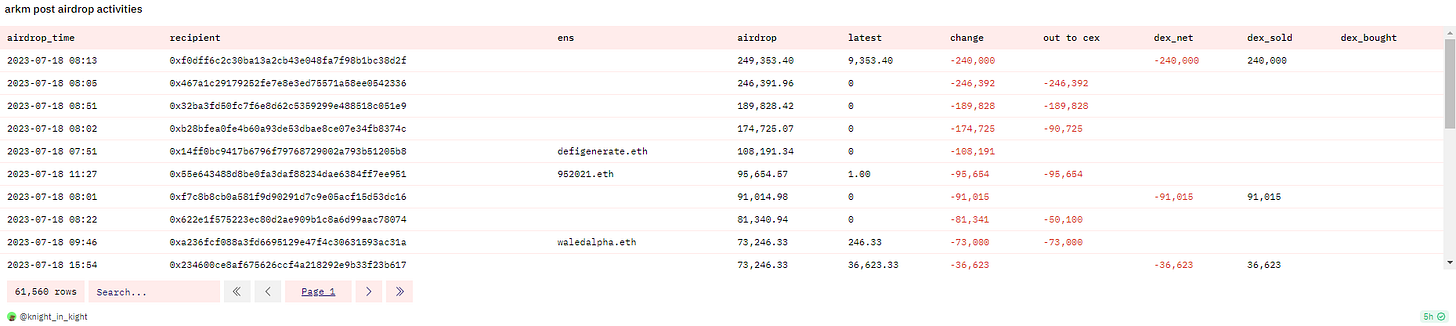

Going through the airdrop leaderboard, it’s clear that most whale airdrop recipients dumped $ARKM immediately after receiving their allocations. The referral leaderboard now becomes a cash-out leaderboard🙁

Let’s take some math to understand how much sell pressure the sellers create. 🧮

In total, around 18M $ARKM tokens were transferred into cexs, around 4.8M $ARKM were sold in dexs. In the meantime, over 2.3M $ARKM were unfortunately farmed (then sold mostly) by airdrop hunters. The selling pressure combined is more than $17M, assuming $ARKM is $0.7 in the first airdrop days.

Who provide for the exit liquidity for these sellers? Apparently, $ARKM holders, liquidity providers and investors pay the bills for the airdrop carnival.🍾

Arkham is a great platform for onchain sleuth. Users can track their favourite whales, alert whales’ move and visualize a social map of a bunch of related addresses. But it also comes with a threshold that users have to know crypto nerd terms, like multi-sig wallet and token vesting, to make good use of it. Therefore, ArkhamIntel’s target users would be the experienced onchain activists and data players.

However, the address age distribution tells a different story.

7-day aged new addresses are the major cohort of airdrop recipients.

Less-than-100-day rookie addresses are the smallest user group.

More-than-100-day OG addresses are the second largest user cohort and possibly the real target users of Arkham products. But the OG address cohort is much smaller than that of new addresses

Taking a dive on airdrop recipients’ nonce distribution, there’s an interesting nonce distribution, which vibes with address age distribution.

Most airdrop recipients have nonces less than 3, indicating they are newly created and may manipulated for farming.

In terms of airdrop amount, most token amounts are allocated to addresses with nonce less than 4, while OG addresses are not well rewarded.

In a brief summary, new addresses are the major beneficiaries of $ARKM airdrop, while OG addresses, who are supposed to be the possible real users of ArkhamIntel platform, are less rewarded, especially when they have few referrals before the airdrop.

Moreover, the recipients’ activities reveal the potential airdrop farmers, who gamed the airdrop rules via manipulating a bunch of branch addresses to maximize their profits.

The most notable airdrop farmers are:

stablemark.eth received 120826 $ARKM from 439 subsidiaries, net profit: $85K (assuming $ARKM is $0.7)

romik.eth received 84696 $ARKM from 397 subsidiaries, net profit: $59K (assuming $ARKM is $0.7)

0x0bf86451ae3932c690548f1a054ea8e303b50201 received 313912 $ARKM from 374 subsidiaries, net profit: $220K (assuming $ARKM is $0.7)

Most tokens that farmers receive have been sold in dexs or transferred into cexs.

In a nutshell, $ARKM airdrop has no escape of farming and seems not to be well allocated to its target users. In addition, the user onboarding event is costly. As what @joel_john95 says, it comes to a cost of $180 in CAC!!!

Airdrop reflections

What can we learn from the $ARKM airdrop? How can we modify the airdrop game? Here are a few takeaways👁👇

Multiple factors for airdrop allocation

Aside from referrals, user age is another good lens for token allocation. Original users tend to be more loyal than referred ones, since they use the products out of real need and help team polish the products.

User activities should also be considered for allocation. Real users can create a dash, track a whale or visualize an address map when using the products. These active users should be rewarded more for their loyalty and efforts to make the platform better.

Ambiguity in rules

Specified airdrop rules can be well gamed. Blurred rules increase the opportunity cost of farmers and leave much room for teams to adjust the initial token distribution. It somehow may not be so "decentralized", but it helps with better airdrop distribution, which matters much more.

More claiming gamification

Most airdrops are one-off token distribution, where users can claim all tokens in one click and leave the platform. The gamification design of claiming is a good method to educate/onboard new users during the claiming process. Eligible users can claim % of their allocations at the beginning and unlock the full share by learning product features or using product functions on the platform.

Phased and variant airdrop

Airdrop can be segmented into several small phases to encourage more users to join and get rewards for using the platform. Each phase of airdrop has different rules for token distribution. In addition, user activities in prior phase can be evaluated for token allocation in latter phase, thus filtering the loyal users.

End

That's all of today’s research! Like/share the blog if you can and feel free to comment what interests you📭

I’d love to shill the great $ARKM dash by 21co__ and tomwanhh: https://dune.com/21co/arkham-intelligence-arkm.

Also check more details in my dash on

: https://dune.com/knight_in_kight/post-mortem-of-arkm-airdropOpinions are my own. This thread is only analytical. NFA!!! DYOR if you want to invest⚠️

Disclaimer: I’m a recipient of $ARKM airdrop. It ain’t much, but honest work😂