Battle of the Exchanges: Analyzing DEX and CEX Performance

In this article, I'll explore the battle of decentralized and centralized exchanges, to find out how DEXs, like Uniswap, match up to major CEXs and what trends are emerging over time.

Decentralized crypto exchanges (DEX) are one of the original decentralized applications (Dapp) on blockchains. With the prosperity of blockchain ecosystems, DEXs are becoming a major crypto native narrative in the crypto world. In this article, I’ll dive into the performance of DEXs and centralized exchanges (CEXs) and explore how DEXs, like Uniswap, match up to these CEXs and what trends are emerging over time.

What are DEXs and CEXs?

DEXs are platforms that enable the onchain trading of digital assets without the need for intermediaries or centralized authorities. Unlike CEXs, which rely on a central entity to facilitate transactions and hold users' funds, DEXs operate by smart contracts on decentralized blockchains such as Ethereum.

There are several key characteristics of DEXs:

No central entities: DEXs eliminate the need for a central governing body or other intermediary. Transactions are executed directly between users through smart contracts or decentralized protocols.

Self custody: Users control of their private keys, which means users have full custody over their funds, reducing the risk of hacks or theft associated with centralized exchanges.

Transparency: Most decentralized exchanges operate on public blockchains, allowing anyone to verify and audit transaction history. This promotes transparency and trust, as the records are accessible to all participants.

Permissionlessness and censorship resistance: Due to their decentralized nature, DEXs generally offer greater resistance to censorship and restrictions compared to centralized exchanges. Transactions cannot be easily blocked or restricted by any central authority, making DEXs attractive in regions with strict regulatory environments.

While DEXs provide certain advantages, they also come with some challenges, including lower liquidity compared to popular CEXs, complexities in user experience, and the risks from self custody.

Different from DEXs, CEXs are platforms that facilitate the trading of digital assets and cryptocurrencies through a centralized authority or intermediary. CEXs rely on a central entity to manage user funds and execute transactions.

There are several key characteristics of CEXs:

Central authority: CEXs have central authorities that manage the exchange platforms, hold user funds, and facilitate trading activities. These central entities act as an intermediary, matching buyers and sellers and executing trades on behalf of users.

Custodial wallets: CEXs require users to deposit their funds into wallets controlled by the exchanges. When users trade on the platform, they are essentially trading IOUs representing their holdings within the exchanges’ infrastructure.

Regulation and compliance: Most CEXs adhere to regulatory requirements imposed by governments and financial authorities. They may implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to verify user identities and comply with legal obligations.

User experience: CEXs often provide user-friendly interfaces and additional features such as advanced trading tools, charting capabilities, and customer support services. These platforms aim to offer a seamless trading experience for both beginner and experienced traders.

The risks of using a CEX include the potential for hacking or security breaches, dependence on the reliability of central authorities, and limited control over users own funds.

What happened in the past year?

The past year has witnessed the greatest collapses/dramas in the both crypto and traditional world. There are a number of events that reshape our knowledge to the whole market and how it works. These events are:

2022/05: LUNA eclipse and UST depegging

2022/07: 3AC bankruptcy

2022/07: The fall of Celsius and BlockFi

2022/11: FTX collapse

2023/02: BUSD banning

2023/03: SVB crisis and USDC depegging

2023/04: Memecoin season

2023/06: Binance FUD

Through these events, it’s not hard to find out that market liquidity is draining and the players with high leverages are washed out of the table.

In the meantime, more regulations and censorship over cryptocurrency are on their way after the FTX implosion. CEXs are naturally the first to be affected. CEXs’ volume has been declining since the LUNA eclipse and retraced back to that of late 2020.

The good news is that DEXs spot trade volume share is in an uptrend, from less than 10% in late 2022 to around 18% now.

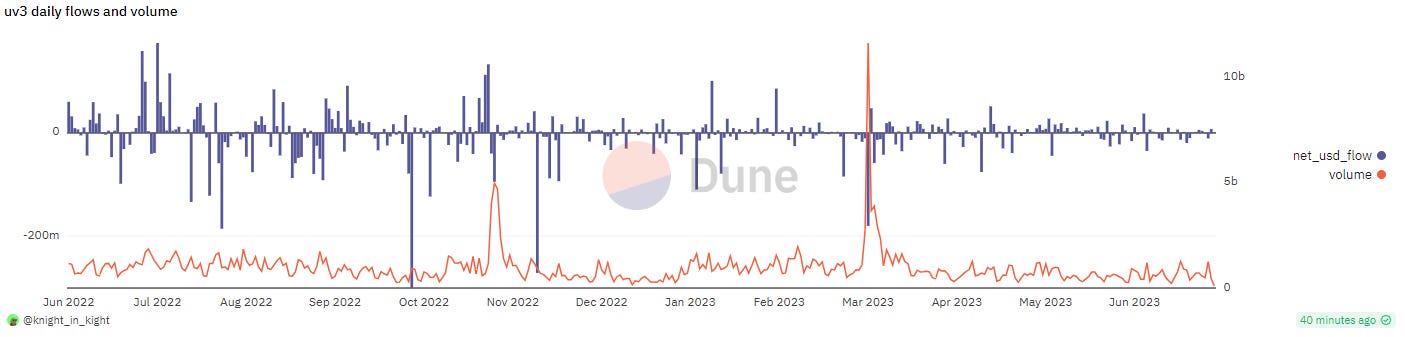

The average daily DEX volume vibrated around 2.5B in recent months and spiked up to 25B during the USDC depegging period. Not bad!

DEX and CEX comparison

TVL comparison

Among the DEXs, Uniswap is one of the most notable DEXs with the largest market share and user base. Since the launch, it has taken over 65% of market volume share and over 90% user share.

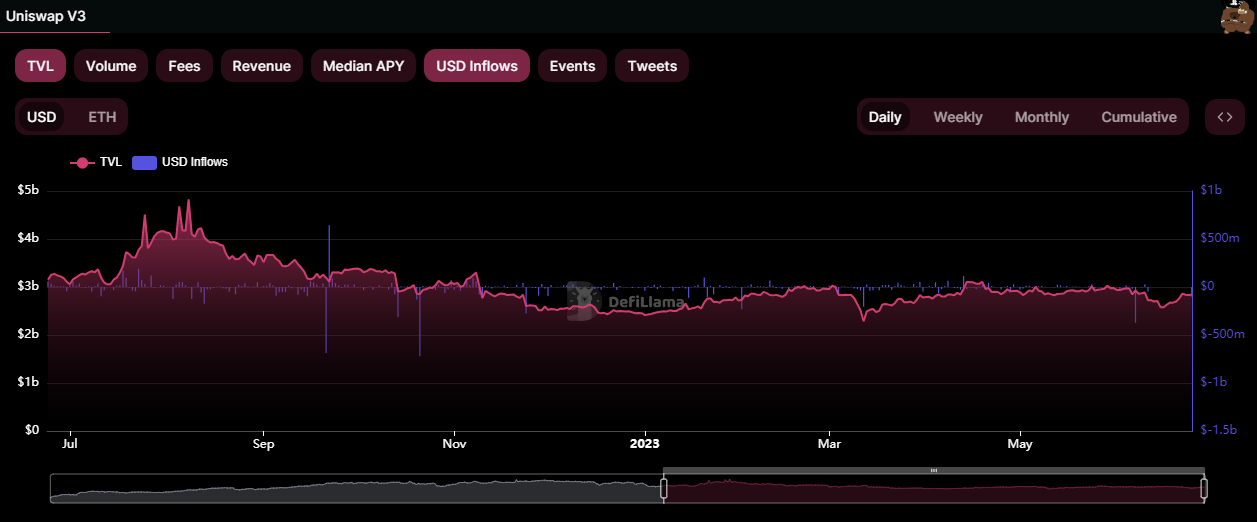

Uniswap is also the top-tier DEX protocol with over $3.5B TVL on mainnet.

Though the TVL declined from the high in 2022, it seems that current liquidity is more “loyal” and the TVL already hits a local bottom now. For instance, Uniswap TVL descended in the USDC depegging, but it quickly bounced in the following weeks and returned to that of before the crisis. The TVL maintenance indicates people are still confident about Uniswap and DEXs. It’s worth noting that Uniswap TVL on multichains is relatively small, but grows quite fast. Impressive growth!

On the other hand, CEXs like Binance open sourced its proof of reserves for CEX transparency after the FTX collapse. The chart demonstrates a clear down trend of Binance reserves on mainnet, where it falls from $30B in the beginning of 2023 to $15B right now. And, there’s no sign of a stop yet.

Binance reserves outflow may be attributed to various reasons, including regulation concerns, market’s slow down and more onchain yields opportunities like ETH staking. The BUSD banning in February caused a slow bleeding of the reserves, while Shapella upgrade in mid April also triggered an outflow of Binance reserves. In a nutshell, more liquidity is exiting CEXs and seeking for security or yields onchain in the past year.

A deep dive on trading metrics

Taking a deep dive on trading metrics on DEXs and CEXs, I’d love to compare the performance of Uniswap and some mainstream CEXs, to see how DEXs evolve and catch up with CEXs competitors.

Coinbase was one of the well regulated and user friendly CEXs, but its volume declined a lot ($300B → $145B) in the past year. Uniswap volume also decreased in 2022, but showed a bounce in Q1, 2023 and even surpassed that of Coinbase.

Currently, Coinbase has over 8M transacting users, which is around 6X of Uniswap users. But it’s interesting that Coinbase's user amount is shrinking, while Uniswap users are expanding, with around 80% user growth rate in the last three quarters.

Since Uniswap smart contracts are deployed on blockchain and run automatically, there’s little operation and management cost on the protocol level. I'd like to compare Uniswap’s liquidity provider fees with Coinbase's gross profits to see who generates more yields and profits. As we can see, both exchanges suffered a huge loss in fees/profits, and Coinbase still can generate over $200M in one quarter. Good news is that Uniswap is catching up and its fee growth is fast in the latest quarter.

Asset liquidity and pool depth used to be an obstacle for whale traders to trade on DEXs. But now, Uniswap has fixed it for major cryptocurrencies. Taking a $100k (W)BTC/USD sell order as an example, Uniswap has an 8-bps market depth, which is quite impressive compared with other major CEXs. Moreover, Uniswap is a paradise for long tail assets, like memecoins. People can even trade these tokens with better liquidity and depth than on CEXs.

User composition of Uniswap and Coinbase varies differently in the past months. Coinbase has declining retailer volume, with around 14% platform volume from retailers now. In contrast, assuming traders with less than $100,000/txs as retail traders, Uniswap retailer volume share is climbing since Q2 2022 and hits over 40% share now. This may indicate the more extensive adoption of Uniswap among retailers, given that Uniswap is an open, permissionless and AML/KYC-free trading platform.

User/asset inflows and outflows

User and asset inflows and outflows are always a vital topic when researching DEXs and CEXs. Since CEXs user inflow and outflow is off-chain and not accessible, I’ll take a look at DEXs’ user flows.

Compared to other DEXs, Uniswap has the largest daily retained user inflows and still maintains an ascending trend since January, 2023.

Uniswap’s daily new user inflows behave a bit differently. New user inflows have a number of spikes and are more event-driven. For example, we can see daily new user spikes during FTX implosion, BUSD banning and USDC depegging events. Interestingly, the user inflows charts reveal that memecoin season may be responsible for the huge user inflows in late April and early May, proving again that Uniswap is the top liquidity platform for long tail assets.

In general, Uniswap V3’s USD flows are relatively stable, compared to its TVL. The asset withdrawals are mostly short termed and event-driven. For instance, during USDC depegging, there were around $200M withdrawals. After the depegging, liquidity and TVL quickly went back to before the depegging. It may ascribe to the high token volatilities caused by specific events, leading to the unpredictable impermanent loss for liquidity providers. Thus, they had to withdraw assets and close positions to hedge the volatility.

In terms of token inflow and outflow, WETH and stablecoins like USDC, DAI are the most popular withdrawal token. It makes sense that they are the most common base tokens for pool pairs. So, when liquidity providers withdraw their positions, WETH and stablecoins are the most popular withdrawal tokens.

CEXs inflow and outflow is rather different. The CEXs inflow and outflow on mainnet in the past year indicates money is basically running out of CEXs. According to the chart below, despite OKx and Bybit having some moderate inflows, Binance has over $12B outflow, 3X than net inflows combined.

More interestingly, Binance's large inflows and outflows happened in a more “indicative” way. The largest outflows happened on 2022-12-14 and 2023-01-30, which were right after FTX bankruptcy and before BUSD banning, respectively. In the former case, I’d speculate institutions or whales withdraw assets to offset their exposures when their wealth in FTX vaporized, or just become panicked about CEXs custody. In the second case, I’d assume that institutions and whale users somehow can “frontrun” the BUSD banning news and try to avoid the regulatory issues.

Stablecoins are the most deposited and withdrawn assets in the CEX flows on mainnet. BUSD, USDC, USDT and TUSD are the Top4 withdrawable stablecoins. Since the end of 2022, there have been continuous outflows of BUSD and when the BUSD banning was announced, BUSD daily withdrawals became more frequent in a short time. USDT is one of the most popular stablecoins in CEXs. Binance can still capture big USDT inflows from time to time, despite the Binance FUDs. USDC inflows in the USDC depegging were low and its outflows past the crisis were more frequent and larger in amount. It was possible to assume that in-CEX arbitrageurs were withdrawing their “cheap” USDC to burn and redeem USDs. Compared with other stablecoins, TUSD was a young competitor, which had much less netflows before February, 2023. The BUSD banning indirectly drove the TUSD activities and share in the CEX flows.

Token flows impact on Uniswap’s trading and user activities

According to Defillama’s Uniswap overall USD inflows chart, there are several large token flows on Uniswap. The table below reveals the major flows on Uniswap in the past year.

It seems that there is no direct correlation between token flows and platform volume, sale or trader amount. However, when token flows lead to market volatility and uncertainties, platform volume will probably surge due to the emergence of onchain risk hedge and arbitrage activities. The USDC depegging is a good example here.

Uniswap V3 metrics are further studied for an in-depth dive on token flows and platform performance. Here are a few findings:

DAI, USDC and WETH are major flow tokens.

DAI-USDC, USDC-USDT, WBTC-ETH and USDC-ETH pairs are major large-flow pools

Before 2023, there were frequent large inflows and outflows. But, large token flows become relatively silent in 2023.

It’s been proved again that volatilities triggered by token flows bring up trading volume.

Pair creation is relatively small during the large token flows, possibly because of the uncertainties on the market.

New users (platform user and nonce_0 user) onboard slowly in most large token flows, but they grow fast in the memecoin season.

DEX trading gains and losses

There are a few cases that show how traders can make profits or suffer losses via trading on DEXs.

The gains

Whale address CZSamSun was buying $USDC during the USDC depegging crisis for arbitrage! He leveraged multiple DEXs and lending platforms to borrow USDT and buy the dip of $USDC. The strategy turned out to be effective. When the USDC repegged, he made a juicy profit of over $1M. You can check more about CZSamSun’s strategies here.

The losses

In the meantime, DEX trading can be a bad bargain. 0x8ff0 was one of the victims in the dark forest and unfortunately exchanged $1.5 at the cost of $2M worth $3Crv tokens. According to 0xngmi, The issue is the wrong aggregation route of 3crv->usdt trade and MEV bots finally harvested the “easy money”.

Social and media exposures

Starting from January 2023, interest in Uniswap is ascending, especially in the USDC depegging period and memecoin season. Though the interest index retraces from high in May, it remains a higher low.

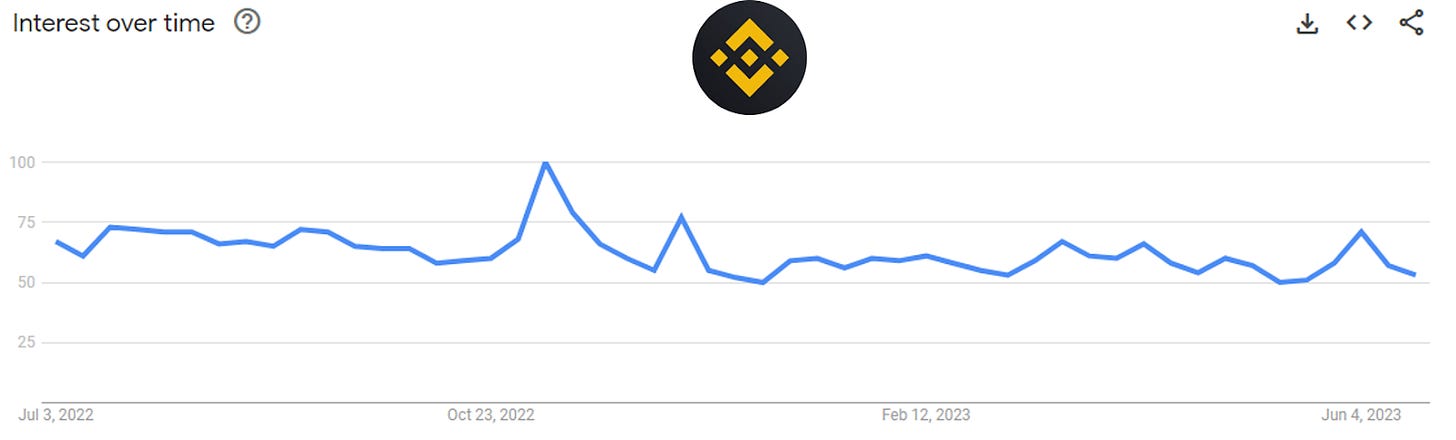

Binance and Coinbase interests have several peaks in the FTX implosion, whale withdrawals, USDC depegging and SEC sues. But in general, people’s interest in CEXs are sideways and somewhat declining in a long-term period.

In terms of Twitter followers, CEXs like Coinbase are follower winners in the FTX fall. It has gained quite a lot of attention in that crisis, but overall, the follower growth is gentle.

Uniswap followers increase in another pattern. Though Uniswap didn’t acquire lots of followers in the FTX crisis, its follower increase speeded up in the first half of 2023 and quickly surpassed 1M followers. Given the fact that Coinbase has 5.8M followers, this is a milestone for crypto native brands and DEXs to get known by more users and even the mainstream.

DEXs and CEXs differences or similarities

DEXs and CEXs play similar roles in the industry. They also share similar performance in some aspects. The similarities include:

Both are fundamental infrastructures of liquidity and users in the crypto industry.

Both are heavily impacted by the bear market and facing liquidity shrinkage.

Both are threatened by regulatory uncertainties and unclear government policies.

The policy uncertainties over cryptocurrencies always trigger DEXs and CEXs volume and arbitrages surge, but liquidity outflows or TVL decreases.

On the other hand, DEXs and CEXs have had some differences during the past year when crises happened. The differences include:

CEXs reserves are declining, due to their vulnerability to single point of failures and regulations orders. DEXs like Uniswap are automatically running on blockchains, thus are more resilient to IRL policies.

CEXs have regional restrictions and limitations on trades or withdrawals. DEXs are open-access and permissionless, where everyone can trade on them. For instance, Uniswap retail user share is growing.

DEXs depth, market share and user base are catching up with CEXs in the bear market. When there’s a CEX risk, the TVL and users tend to migrate to DEXs to get better liquidity exposure.

CEXs TVL is in a decline, while DEXs started to bounce. Assets are outflowing from CEXs to blockchains to hedge custody risks and seek more yield opportunities.

Uniswap is a popular liquidity platform for long tail tokens. Sometimes, long tail tokens have better liquidity on DEXs before central listing.

Tomorrow of DEXs

DEXs have a bunch of overwhelming advantages against CEXs, but there is still a long way to go, to make DEXs easier, more user friendly and secure. Currently, some pain points of DEXs adoption remain unsolved for years, including:

High trading cost in gas fees and long confirmation when networks congest. The skyrocket of Uniswap users on layer2 chains proves that users do care about gas fees and trading speed. People want less fees but more speed.

User friendly infras are lacking. Users need to figure out how to use wallet properly and onramp fiats before they start to trade on DEXs. It’s demanding for users to learn so much beforehand.

User interface is complex and the threshold of using DEXs is high. Users have to be crypto experts to understand the trade details, like contracts and slippages. Or, they will be punished by their “innocence”.

User security is vulnerable when users are very likely to get exposed to MEV bots, hackers and phishers. Self custody is cool but far less secure than we think. There are phishing victims everyday according to scamsniffer’s phishing victim chart.

CEXs overcome most of the above challenges, however, they have their inherent defects of single point of failure. In the long run, I’d believe the disadvantages that DEXs have now are more temporary and technical. With the development of scaling technology and native user experience improvements like account abstraction, DEXs may have another day in the near future.

Conclusion

Both CEXs and DEXs have experienced volume and user loss in the bear. But, through the lens of TVL, onchain inflows and outflows, as well as user activities, we can foresee an increasing share of DEXs, like Uniswap, especially when more regulations and policies are imposed on CEXs and other central entities. It is more clear that DEXs are fundamentally more resilient, permissionless and transparent than CEXs, even though they still have some problems in user experience.

Meanwhile, DEXs basically provide a free market for both major and long-tail assets to be traded freely. To some extent, DEXs are becoming a liquidity market for small-cap tokens and other alternative assets.

As DEXs are expanding to multichains, which have lower latency and lower gas fees, a universal market will be activated to facilitate value free flows across chains. It’s not hard to see even some major CEXs are building their own DEXs to migrate their offchain users and attract more onchain users.

Disclaimer:

This is not financial advice. Do your own research when you want to invest.

This research is inspired by Unigrants Community Analytics Program (UGPCA)