The costs and gains of airdrops

14 popular airdrops in 2020-2023 are studied to help you find out the costs and gains of airdrops as well as how they develop to become more effective for protocol growth over time

Introduction

What is a cryptocurrency airdrop? An airdrop is a distribution of free tokens or coins to existing cryptocurrency holders. It's a marketing strategy used by projects to raise awareness, generate interest, and reward their community members. An airdrop is now considered the most exciting way to start token distribution and launch project communities.

Uniswap airdrop is not the first airdrop in cryptocurrency, but one of the most massive and profitable airdrops in 2020. Since then, more projects utilize airdrops for initial community launch and thousands of people get rich overnight in the airdrops. However, airdrops can be costly for projects, especially when a portion of eligible users are speculators and farmers. Do airdrops really make sense now?

In this blog, I’ve taken a dive on 14 popular airdrops in 2020-2023 and tried to reveal the costs and gains of the airdrops as well as how they develop to become more effective for protocol growth over time. There is a bonus alpha at the end of the article, for those who finish the reading. Don’t forget to grab a look!

Let’s jump into the rabbithole now!

The notable airdrops

The 14 airdrops studied in this article are:

Uniswap airdrop on 2020-09-16

1inch airdrop on 2020-12-25

Ampleforth airdrop on 2021-04-21

Ribbon finance airdrop on 2021-05-25

DYDX airdrop on 2021-09-08

ENS airdrop on 2021-11-09

Paraswap airdrop on 2021-11-15

Looksrare airdrop on 2022-01-10

Apecoin airdrop on 2022-03-17

Optimism airdrop on 2022-06-01

Hop protocol airdrop on 2022-06-09

Blur airdrop on 2023-02-14

Arbitrum airdrop on 2023-03-24

Arkham airdrop on 2023-07-18

There are still many other great airdrops, like Cowswap and Safe airdrops, but I’ll only cover the mainnet airdrops with currently circulating tokens in the analysis.

The airdrop reflections

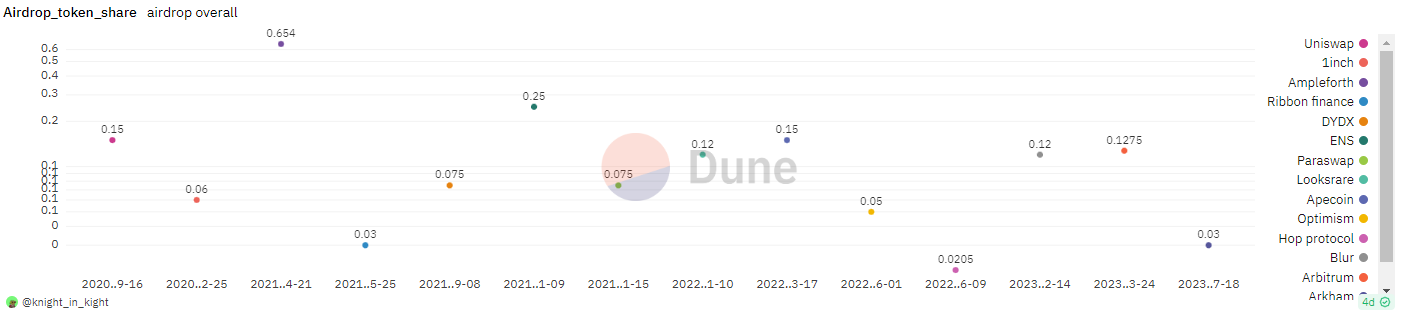

Airdrop token share

The airdrop token share varies between 3% -15%.

Community centric projects like ENS and Ampleforth, tend to have aggressive token shares for communities, which are over 20% or even more.

New and old users

New address shares in most airdrops are less than 20%.

In this case, an address with nonce < 5 is defined as a new address. The nonce is the number of transactions sent from a given address. Therefore, the nonce number somehow demonstrates how old/frequent an address is onchain.

Zooming in, there are a few more fun facts:

Early airdrop projects like Uniswap and 1inch, have around 5% -10% new address ratio. Since there were few farmers back then, the 5% -10% ratio seemed to be organic.

Hop protocol started a massive anti-sybil program during their airdrop and had their new address ratio at 11%, which was quite close to the organic range. The anti-sybil method of Hop protocol seems to work out as planned!

There are few new addresses in NFT marketplace airdrops, indicating NFT marketplace teams are trying to attract experienced players and their claimants are more likely to be OG onchain users.

In general, the larger new address share (mostly > 10%) may indicate the higher suspicion of airdrop farmings. But, it also depends on the airdrop rules. For example, Optimism has over 45% new addresses, but most of them are old users on other chains, who are newly onboarded into Optimism ecosystem.

In contrast, Arbitrum has much less new address share. Because Optimism and Arbitrum have different airdrop strategies, where Optimism tended to attract new users outside the Optimism ecosystem, but Arbitrum tended to reward existing loyal users and strengthen their stickiness.

Airdrop claimants

20%-50% eligible users are idle in the airdrops.

Not every eligible user will claim their airdrops. The claimant ratio sits between 50%-80% in most airdrops.

Claimant amount also varies a lot in different projects. Infras and chain-level projects usually have bigger claimant amounts (> 100k). Among them, Arbitrum airdrop attracted over half a million claimants, leading on the airdrop claimant leaderboard. It’s possibly one of the most extensive airdrops in crypto history.

Unclaimed tokens

4%-25% of tokens are left unclaimed in these airdrops, and project teams begin to recycle unclaimed tokens for better budget management.

There will always be some tokens left unclaimed in the airdrops. Unclaimed token share is an interesting metric in the airdrops, where too high unclaimed ratio may indicate the imprecise target receivers, while too low unclaimed ratio may suggest the limited group of eligible users or overload of airdrop farmers. It can also be seen that the unclaimed ratio stays sideways between 3% - 7% since the mid of 2022.

Another interesting topic is where the unclaimed tokens flow. In the early airdrops, unclaimed tokens remain idle in the airdrop contracts. You can still claim your $UNI or $1inch airdrops if you’re eligible. There’s no expiry for claims. But in recent airdrops, airdrop tokens have expires and the unclaimed tokens will go to the community treasury and be recycled for future usages, like product developments. Here are some examples:

3.5M unclaimed $Forth were transferred to the timelock contract

5.4M unclaimed $ENS were transferred to the ENS DAO

21M unclaimed $Looks were transferred to LooksRare channel multisig

16M unclaimed $Blur were transferred to Blur team multisig

It’s a smart move for teams to make good use of their budgets. But for an eligible user, their airdrops have a shelf life now. So, remember to claim the airdrops early if possible.

BTW, if you don’t know what airdrops you’re eligible for, Daylight (non-sponsored shill) helps and tells you when and where to claim the unexpected fortune.

Claiming speed

Day2_claim% is climbing since 2021 from 40% to a staggering 92% in 2023.

The day-2 claiming percentage (day2_claim%) of tokens post the airdrop is evaluated for user engagement of airdrop claiming in this article.

The growing day2_claim% indicates the growing awareness and engagement of community members, which shows that airdrops are more popular in the community campaign or project marketing. However, this metric also raises the concern of airdrop farming, since farmers are more likely to claim tokens when claimings are open and cash out immediately.

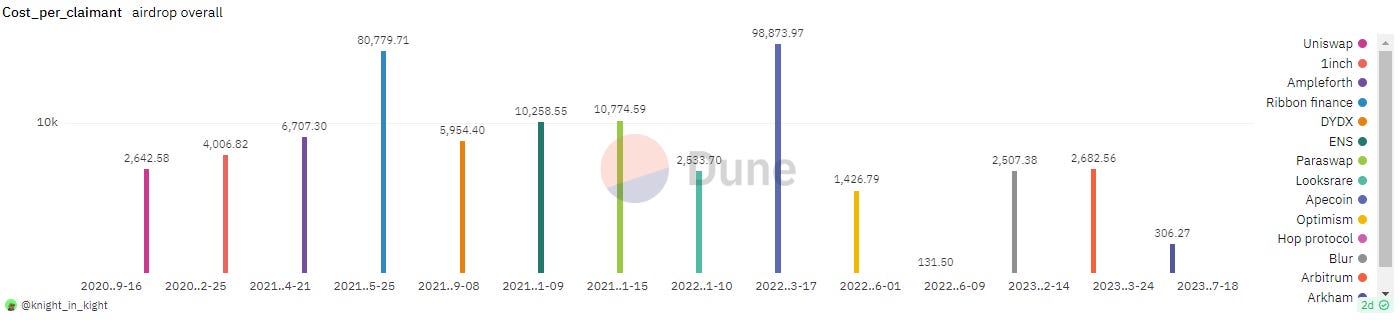

Airdrop cost and impact to protocols

The average cost per claimant is between $1000-$10000. Well designed airdrops boost the protocol fundamentals.

Airdrop cost per claimant is another key metric when evaluating the “PnL” of project airdrops. In the article, airdrop token prices are calculated according to the first weekly average token price.

Mid 2022 is a watershed moment for crypto airdrops. Before Mid 2022, people can expect rewards of over $2500 in an airdrop, but after that, the average airdrop rewards encounter big discounts. It’s worth noting that niche markets (like Ribbon Finance in the option market and Apecoin in the Yuga NFT community) may incentive their loyal followers with higher average rewards, since they have relatively smaller communities.

Does such an airdrop cost really make sense? Let’s take a look at a few airdrops’ impact on the protocols. To my surprise, the NFT marketplaces’ airdrop seems to be very bullish to the protocol fundamentals. After the airdrops, Looksrare and Blur both got rapid growth in trading volume. Due to the well designed airdrop strategy, Blur’s volume grows more sustainably and even surpasses that of Opensea.

Similar story happens to L2 chains like Arbitrum and Optimism. Despite a short term hype and cold down, both L2 chains attract more active users and TVL after a massive airdrop.

However, airdrops are not always a plus for fundamentals. The Paraswap and Hop protocol airdrops have led to a decline of trades or TVL. Why? It may be explained by the outflow of airdrop farming. Both protocols are heavily farmed by airdrop hunters, which inflated their trading metrics with toxic flows (It also explains why both protocols have anti-farmer rules). When airdrops are distributed and farmers cash out or get filtered, the toxic volume slips away and protocol fundamentals get rekt… at least in a short time. Interestingly, in the long run, their airdrops do onboard some loyal users. As we can see, a portion of users and volume come back to use products after airdrops, contributing a decent growth of protocol fundamentals again.

In a brief summary, airdrop cost per user can be thousands of dollars in a bull market. Even though bear markets discount airdrop values, it’s still an expansive marketing campaign. In the long run, airdrops generally onboard more users and volume. But, the point is how airdrop strategies bootstrap effective and sustainable protocols growth in an affordable way. That’s why airdrop strategies are worth more research.

User activities post airdrop

Most airdrop claimants seem to be flippers.

When the unlocked tokens are distributed directly into claimants’ addresses, they tend to sell tokens and realize profits. Look at the chart below, a big amount of $UNI claimants have 0 $UNI in a week after claiming the airdrops, where most $UNI are sent to CEX or flowed into DEX.

The $UNI price pattern shows the user activities more clearly. Despite the bounce due to the initial oversell, the price undertakes a continued sell pressure.

Governance engagement

Most airdrop claimants have little interest in Snapshot votings.

You may wonder if claimants are interested in governance. The answer for most projects is NO. Notable projects like Uniswap and 1inch, have less than 1% of governance engagement among all the claimants.

To my surprise, some projects outperform the averages. Among the samples, ENS has over 84k voters and incredibly 82.3% claimant engagement ratio. Looks like the ENS community is real chads! Once again, niche communities have relatively higher governance engagement, due to the smaller communities and similar user portraits.

Arbitrum and Optimism airdrop claimants are both active (around 10% engagement) in governance, but in the absolute amount, Arbitrum has a much larger voter base of over 59k.

Airdrop smart money

53 super onchain geeks are claimants in around 10 airdrops

You might wonder who the most active users are in the airdrops and who won the most in the game?

So, it’s bonus time to tell you who they are! In fact, there are:

14573 overlapped claimants in the L2 airdrops

7826 overlapped claimants in the Web3 airdrops

2328 overlapped claimants in the DeFi airdrops.

These claimants have received multiple airdrops and gained thousands of free money in each segmentation. However, onchain OGs can harvest even more profits. By selecting in the major airdrops, there are 53 super hardcore users, who are claimants in around 10 airdrops. The notable users include:

Top1 🥇 isimpmolly.eth, https://twitter.com/CryptoMaestro with $606k

Top2 🥈 dereek69.eth, https://twitter.com/Dereek70 with $428k

Top3 🥉 0xnigiri.eth, https://twitter.com/Nigiri0x with $379k

and more on the dune dash…

These users are not only the onchain veterans, but also super active in testing or trying out new projects. Now, you know what to do when you want to have a try on the latest protocols or products onchain, don't you?

Conclusion

Is airdrop a dead end now? Honestly, I don’t know for sure. But this article may give you an overview of how the major airdrops happened and how they developed to try to balance the costs and gains in the past 2 - 3 years.

Airdrop campaigns are actually a great way to decentralize token distribution and acquire new users. However, the current methodology is not maximizing the benefits of both users and protocols as protocols usually spend $4000 on average to acquire one user in the above samples. Traditional airdrop rules and distributions are also vulnerable to farmers and bots. Moreover, claimants are not well incentivized to hold after the airdrop and align with projects’ long term benefits. There’s no reason for them not to realize the profits. The costs and gains are not well balanced, due to lack of sophisticated airdrop strategies.

Thanks to the airdrop pioneers whom we can learn from, protocols can now have multiple strategies for a more effective campaign, like:

Adoption of filtering mechanism to avoid double paying the same users

Utilization of a point system to reward real users and increase the activities/revenue of the protocol

More offchain monitoring and ambiguity/probability in airdrop rules to protect airdrops from being precisely gamed

More airdrop claiming gamification, where eligible users can claim % of their allocations at the beginning and unlock more by learning or using product features and functions

Phased and variant airdrop, where airdrop can be segmented into several phases to encourage more users to join, and tokens are distributed by various rules in each phase. User activities in prior phases will be evaluated for token allocation in latter phases, thus filtering the unloyal users

More methods to retain airdrop claimants: e.g. locking and staking after receiving the airdrop can entitle a bonus offering

I also shared some thoughts on airdrops in the $ARKM airdrop thread, feel free to grab a look: https://twitter.com/0x_knight/status/1682373836799619073.

In fact, there are already some good attempts to modify the airdrop campaigns to benefit more community members and avoid sybil attacks. Delphi Digital gigas and Astroport team have introduced the innovative lockdrop mechanism to incentive users who have long-term commitments. Blur team also made great contributions in airdrop design, where they adopt points based incentives in several seasons to encourage more users to join the airdrop. These innovations serve as symbols of the increasing maturity of airdrops’ development.

So, what can we do as an ordinary user? My advice would be: follow the onchain gigas and try out the fun, then wait for the good news, or probably nothing.

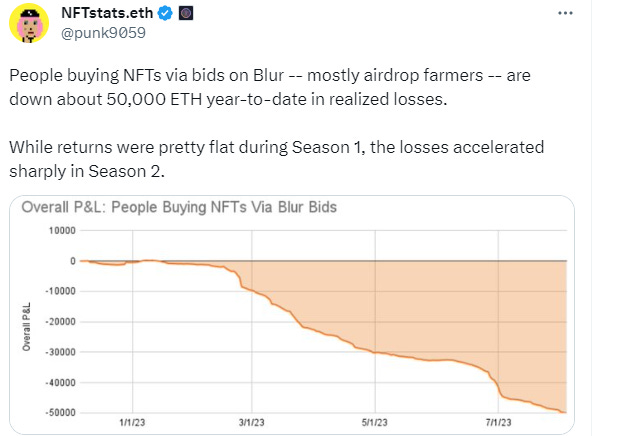

Farming airdrops seems not to be a good idea in such a bear. Take a look at Blur season2 farming PnLs, you know farmers are bleeding and it’s a brutal game where farmers stand little chance to win.

That's all of my article! Thanks for your patience and reading it all. Please check my dash for more analytics on Dune Analytics: https://dune.com/knight_in_kight/reflecting-on-airdrops

Also, I’d like to shill Jack’s masterpiece if you’re interested in airdrop study: https://dune.com/blog/uni-airdrop-analysis

Opinions are my own. This blog is only analytical. NFA!!! DYOR if you want to invest⚠️ Share the blog if you can and feel free to comment what interests you📭

Special thanks to the CT gigas who help review this article:

Give them a follow if you’re looking for more in-depth data analytics.

Standards and criterions

Major mainnet and L2 airdrops are evaluated in this article, and airdrops on non-EVM chains like Aptos are not covered.

Optimism and Blur have phased airdrops, but only season-1 airdrops are involved in this article.

The total airdrop eligible addresses are unknown in several airdrops (Arkham, Blur and etc), so their claimant ratio is not included.

Airdrop raw data is from dune analytics and other analytical platforms, and links will be referred below.

Methodology

The day-2 claiming percentage (day2_claim%) is calculated by: Total supply /all tokens claimed till day 2 post the claiming * 100%

The token/claimant amount in some cases is approximate.

L2 airdrops include: Arbitrum, Optimism and Hop protocol airdrops

Web3 airdrops include: Blur, Looksrare and ENS airdrops

DeFi airdrops include: Uniswap, 1inch, DYDX and Amperforth airdrops

Governance engagement is defined with the voter ratio in total claimants. when the voter ration is <5%, it’s “Low engagement”, 5%-20% is “Medium engagement” and >20% is “High engagement”.

Reference

$UNI Airdrop Beneficiaries: https://dune.com/batwayne/dollaruni-airdrop-beneficiaries

1inch token: https://dune.com/0xBoxer/1inch-token

DeFi trader scores over $20 million in 1INCH token Christmas airdrop: https://cointelegraph.com/news/defi-trader-scores-over-20-million-in-1inch-token-christmas-airdrop

FORTH Airdrop Γ: https://dune.com/hildobby/FORTH-airdropped-token-claims

Ribbon Airdrop Analysis: https://dune.com/lsquared/Ribbon-Airdrop-Analysis

RBN Airdrop Distribution: https://ribbonfinance.medium.com/rbn-airdrop-distribution-70b6cb0b870c

dydx Airdrop: https://dune.com/Orilla/dydx-Airdrop

dYdX Drops Over $1B to Past Users in Airdrop: https://thedefiant.io/dydx-airdrop

Introducing DYDX: https://dydx.foundation/blog/introducing-dydx-token

ENS Airdrop 🔤: https://dune.com/hildobby/ENS-Airdrop

The ENS DAO governance token airdrop has now officially *ended*: https://twitter.com/ensdomains/status/1522066354387718144

PSP Airdrop 🔼: https://dune.com/hildobby/PSP-Airdrop

ParaSwap Airdrops PSP Governance Token to ‘Active Users’: https://thedefiant.io/paraswap-psp-airdrop

LOOKS Airdrop 👀💎: https://dune.com/hildobby/LOOKS-Airdrop

LOOKSRARE Airdrops Token and Entices NFT Fans to Try Out New Marketplace: https://thedefiant.io/looksrare-airdrop

APE Airdrop 🦍: https://dune.com/hildobby/APE-Airdrop

Bored Ape Yacht Club Launch ApeCoin with APE Token Airdrop: https://dappradar.com/blog/bored-ape-yacht-club-launch-apecoin-with-ape-token-airdrop

62% of the total supply of ApeCoin is allocated to the ApeCoin community:

https://twitter.com/apecoin/status/1504201558917095427

Optimism's OP Airdrop 🔴🎁: https://dune.com/hildobby/op-airdrop

Optimism - Airdrop #1 Claims & Vote Delegations 🔴🏛: https://dune.com/optimismfnd/optimism-airdrop-1

Optimism Airdrop 1: https://community.optimism.io/docs/governance/airdrop-1/#

HOP Airdrop 🐇: https://dune.com/hildobby/HOP-Airdrop

Hop Protocol Airdrops Over 20M Governance Tokens: https://www.coindesk.com/business/2022/06/10/hop-protocol-airdrops-over-20m-governance-tokens/

$BLUR (post airdrop action stats newly added): https://dune.com/pandajackson42/blur-airdrop

Arbitrum Airdrop: https://dune.com/blockworks_research/arb-airdrop

ARBITRUM: THE NEXT PHASE OF DECENTRALIZATION: https://arbitrumfoundation.medium.com/arbitrum-the-next-phase-of-decentralization-e7f8b37b5226

Arkham Intelligence Airdrop (ARKM) Analysis: https://dune.com/21co/arkham-intelligence-arkm