The NFT Lending Arms Race

Over the past year, we’ve seen NFT trading volumes decline precipitously, causing the entire industry to rethink what drives value to NFTs. However, while trading volumes are down, lending volumes have increased as many new protocols have entered into the mix, experimenting with different designs to maximize liquidity for holders.

With now more than 10 active protocols offering NFT lending, the battle for users is heating up! Who’s winning, who’s losing, and who has the best chance of coming out on top?

I’ll discuss all of that and more in the below chapters.

What is NFT lending and why should you care?

NFT lending is an industry that allows owners of NFTs to borrow money while posting their NFTs as collateral. NFT lending has grown tremendously in the last 2 years, from less than $1M in outstanding debt in 2021 to over $130M today. During that time, there have been over $2B in loans originated.

2023 is a milestone for NFT lending market, whose outstanding debt volume rallies and hits a new ATH since the early of 2023. In particular, we’ve seen significant interest in NFT lending upon the release of Blend from Blur and Paradigm, which quickly shot up to become the number one NFT lending platform due to their incentive program for users.

So, what’s changed in the market landscape over 2023?

Before the deep dive, I'd like to segment the first half of 2023 into 3 periods:

The recovery (Jan - Feb)

Post Blur airdrop (Feb - Apr)

Post Blend launch (May - Now)

Top 5 in Period 1: Benddao, NFTfi, X2Y2, Paraspace and Arcade

Top 5 in Period 2: Paraspace, NFTfi, X2Y2, Arcade and Benddao (Only rank change in protocols)

Top 5 in Period 3: Blend, NFTfi, Paraspace, Arcade and X2Y2 (Blend in absolute domination)

What do we learn from the charts?

I've summarized some interesting findings to help you see the patterns in the NFT lending market.

The Peer-to-Pool Players

BendDAO

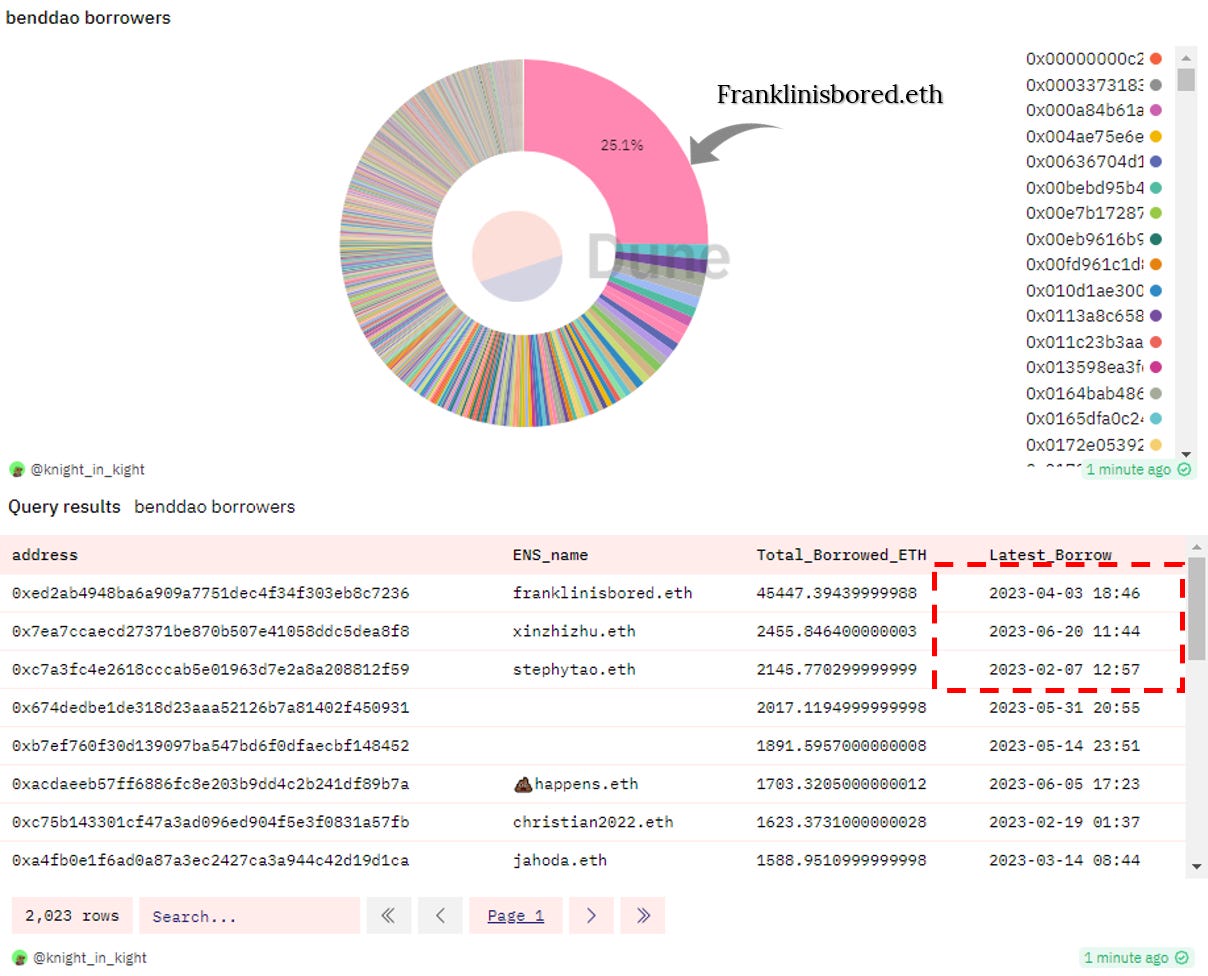

BendDAO used to be the top ranked lending protocol with 47% market share. However, its volume plummeted since February and only 6% market share remained before Blend launch.

It seems that the departure of super whales like @franklinisbored, xinzhizhu.eth and @dingalingts took a heavy hit on its performance.

In the meantime, $BEND price has nose dived from $0.03 to $0.005 (83% down).

The metrics indicated that BendDAO’s early performance was largely correlated to farming of the governance token $BEND. Now that those rewards have decreased, there’s less excitement from users to engage with the platform.

Paraspace

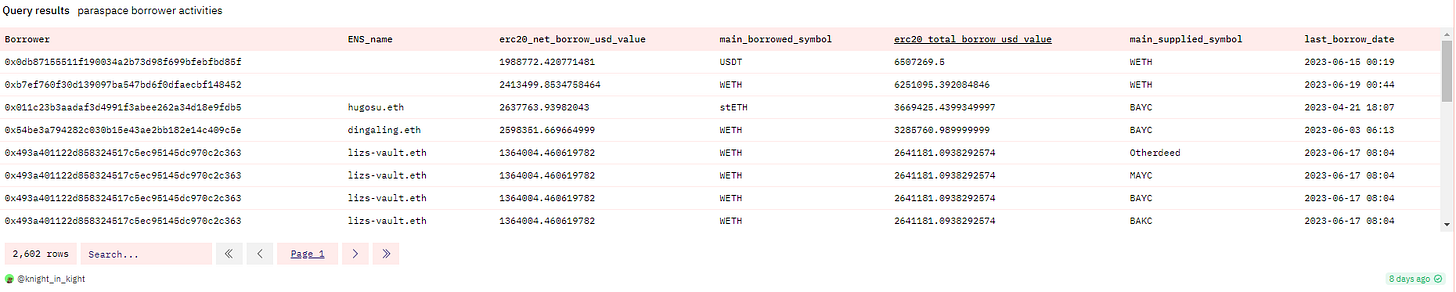

Paraspace is a new NFT lending protocol that supports NFTs and Uniswap V3 LPs as collateral. March and April were the golden months for Paraspace, where its market share spiked from 6% up to 57%.

However, the infighting amongst the core team caused FUD in the community, resulting in a free fall of its loan volume and fluctuation of community confidence.

Good news is that Paraspace has bounced back from its recent lows and still has some loyal users, like dingaling.eth (formerly a loyal user of BendDAO), with promises of a “points” program.

The Peer-to-Peer Players

NFTfi, X2Y2 and Arcade

Despite the market volatility, NFTfi, X2Y2 and Arcade performed steadily with market share of 20%-30%, 10%-20% and ~10%, respectively.

This performance was mostly achieved without token rewards or point incentives. The volume and user growth seems to be organic and loyal.

Blend

The launch of Blend is game changing. It attracted $50M loan volume in the first week, flipping others' combined volume and taking a lion's market share of 74%.

Blend was record-breaking in the following weeks of its launch and hit $180M loan volume in early June with 94% market domination. While the volume stats might be somewhat inflated due to the short duration of the loans, the outstanding debt metrics still point to Blend leading the way, albeit not as overwhelmingly.

How did Blend make it?

Blend is born with Blur's bidding pool and the point system, which paves the way of Blend’s huge success. Liquidity and incentives become the flywheels of Blend's growth hack.

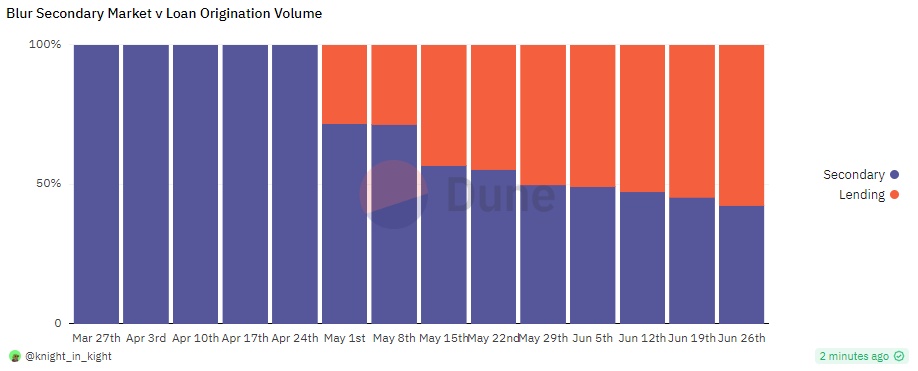

Right now, NFT selling via Blend loans are royalty free. Royalty circumvention is a lure that no pro traders can reject. The royalty “loophole” has attracted more liquidity in Blend and its loan volume has even exceeded Blur’s marketplace volume, according to @1kbeetlejuice’s query.

Fun facts

Blend’s genesis users and its siphonic effect

Blend volume growth did not impact much on others' volume in the first month, which indicated Blend only onboarded native users in the Blur system and there were few users overlap between Blend and other protocols.

While user overlap between Blend and the other platforms remains low, Blend’s continued volume dominance suggests the other protocols need to incentivize users to stay with them somehow… Or, Blend will adsorb more non-native users and volume on the market!

This probably explains the launch of Paraspace and NFTfi's point system.

Why did Blend's volume skyrocket, but NFTfi's didn’t pump much, even when they both have point systems?

A point system is helpful for a protocol’s cold start. But, it doesn’t guarantee more users and volume in the protocol. A growth hack can be composed of good liquidity, juicy incentives, excellent user experiences and more.

I’d like to share a few of my ideas on the different effects of point systems of Blend and NFTfi:

Blend is backed by bidding pools and inherits liquidity/users/fame from Blur ecosystem. It’s not a cold start for Blend launch.

Blend has a clear target user group, aka pro traders, who can naturally contribute more trades and volume than ordinary users.

Season1 $Blur airdrop is successful and people expect high for Season2. In contrast, NFTfi's points value remains unknown.

Blend has lower loan fraction than NFTfi, especially in gas fee per loan (great work from the paradigm gigabrains for gas optimization).

Blend has a more efficient user interface and clear lending metrics display over NFTfi.

Blend today vs tomorrow

While Blend has turned heads with its quick ascension to the top spot in NFT lending, its staying power remains to be seen. When comparing LTVs, for example, Blend is offering basically the same terms as the other P2P platforms (Guess why NFTfi has a big candle for >100% LTVs!). Will the users still prefer Blend after they getting their tokens? Or will we see a similar decline as BendDAO?

One more thing: The new entrant

Apart from Blend, there are still innovations springing up in the NFT lending market. For instance, Metastreet just launched a new NFT lending protocol design recently - the “Automatic Tranche Maker” or ATM. The ATM is a hybrid of the P2Pool and P2Peer designs. While the ATM is new, MetaStreet team has been around for nearly 2 years as major participants in NFT lending, having done over $60M in loan volume. The ATM offers a design for maximum LTVs through pooled capital, a pioneer in the lending market. Check the ELI5 video to learn more.

Final thoughts

It's never easy to build up liquidity and user base in such a bear market and NFT cold winter (My respect to all the NFTfi builders). NFT lending is a rising segmentation in NFT finance. Leveraging existing liquidity and composability of blockchain, it can unlock more capital efficiency and wrapped yields.

Though the NFT lending market has surged in recent months, it's still in the pioneering age.

Some potential problems still remain unsolved in NFT lending:

Sustainable incentives for platform engagement

Possible manipulation of NFT floor prices (kudos to @deepnftvaluebot , @waterfall_mkt)

Smart contract vulnerability and corresponding risk handling solutions

Liquidity fragmentation (kudos to @reservoir0x for aggregating liquidity)

Creators' royalty issues (kudos to @manifoldxyz for royaltyregistry)

More user friendly entrances or wrapped products for end users (kudos to @spice_finance )

The end

Thanks for your reading here!

Also, I want to shill the great dashes by @ivnktski and @1kbeetlejuice , go check more lending metrics on @DuneAnalytics :

The opinions are my own. This article is only for analytics and not intended to criticize any protocols. I have no interest in the above-mentioned projects.

⚠️This is NFA and DYOR if you want to invest.

Feel free to share the article with your friends and feedback on twitter @0x_knight ❤️