The Phoenix Rise of Solana: From Flames to Blockchain Fame

Blazing Speeds, Growing Pains, and the Quest to Redefine Mass Adoption

Thanks for reading and you can check the TLDR thread here

Follow me on Twitter for more crypto analysis

Background

The evolution of blockchain technology parallels that of the Internet in many ways. Just as the internet revolutionized information exchange in the 1990s, blockchain emerged in the 2010s as a potential transformer of trust and value transfer in the digital realm.

Bitcoin, introduced in 2009, established the concept of a decentralized payment (initially) and the digital gold. Ethereum followed in 2015, expanding blockchain's capabilities with smart contracts and opening a world of possibilities. However, as adoption grew, these early networks faced challenges in scalability and transaction speeds, which led to the development of various solutions, including alternative layer-1 chains and layer-2 networks. Each solution aims to address what became known as the blockchain trilemma: balancing security, decentralization, and scalability.

Amidst this landscape of innovation and experimentation, Solana emerged as a notable entrant. With its unique approach to consensus and network design, Solana represents another step in blockchain's ongoing evolution, demonstrating new possibilities in transaction speed and cost-efficiency while maintaining a decentralized structure.

Introduction

Unsolved Problems

Imagine a blockchain that moves at the speed of thought, where transactions cost less than a stick of gum, and games run as smoothly as they do on your PlayStation. That's the promise of Solana, an open-source smart contract platform that's pushing the boundaries of what we thought blockchains could do.

While Ethereum deserves a medal for educating the masses on the potential of decentralized networks, it's starting to show its age. It encounters several challenges when onboarding more users, including:

High Cost: Transaction fees on Ethereum mainnet are prohibitively expensive for most retail users, often costing several dollars per transaction.

Slow Speed: Ethereum’s block production every 12 seconds and the minutes it takes to reach transaction finality are inadequate for supporting thousands of users.

Decentralization and Security: Some Ethereum scaling layer2 solutions improve performance and efficiency but compromise decentralization and security, leading to potential manipulation and attacks.

What Makes Solana Stand Out?

Unlike the EVM blockchains, Solana is a new species altogether. While other networks try to build a sailboat of scalability, Solana has built a hydrofoil. Its secret sauce? A ground-up redesign that turns blockchain limitations into strengths.

Numbers speak louder: Solana processes transactions at a cost of a mere $0.00025 per transaction. That's genuinely cheaper than a grain of sand. Speed-wise, Solana can process up to 65,000 transactions per second. For context, that's not just faster than Ethereum's 15-30 TPS; it's in a different league entirely, outpacing even Visa's 1,500-2,000 TPS.

But raw speed isn't everything. Solana maintains its decentralized ethos with over 3,400 validators spread across six continents, collectively staking more than half of the circulating SOL. This global validator network isn't only a point on a map, but also a fortress of security and a testament to the network’s decentralization.

Solana reimagines what blockchains should be. It's the blend of speed, affordability, and decentralization that has propelled Solana to become the third-largest blockchain ecosystem globally, nipping at the heels of the crypto old guard, Bitcoin and Ethereum. In the high-stakes race of blockchain scaling, Solana is setting the pace.

The History

Solana’s journey began in 2017 when Anatoly Yakovenko published a white paper introducing the Proof of History (PoH) concept, aimed at addressing blockchain scalability issues. Then in 2018, Solana labs, the driving force behind the Solana blockchain, was founded by Anatoly Yakovenko and Raj Gokal. Solana blockchain was officially launched in March 2020 and it quickly gained attention for its high-speed and low-cost transactions.

Solana was known for being promoted by Sam Bankman-Fried (SBF), the founder of FTX, as a faster and cheaper alternative to Ethereum, which helped boost the initial visibility and adoption.

However, the collapse of FTX in November 2022 had a substantial impact on Solana, causing the ecosystem to experience a slump for a period. Despite these challenges, the Solana ecosystem has continued to grow, marked by increased developer activity and onchain engagement. Today, Solana has become an indispensable player in the crypto universe.

Solana Fundraisings and OTCs

Since its inception, Solana has consistently attracted significant funding, reflecting its growing prominence in the crypto space. Here are a few periods that highlight the funding history of Solana.

Private and Presales (Before 2020)

Between April 2018 and January 2020, Solana Labs raised tens of millions through private sales and presales. The early investors were able to purchase SOL at the price of around 20 cents/SOL. Notably, Multicoin Capital led the $20-million series A round in 2019, setting the stage for Solana’s ambitious development goals. Kyle Samani, cofounder and managing partner of Multicoin Capital, once explained, “Solana is the closest thing to the ‘world computer’ blockchain developers conceptualized in the early days of crypto.”

Seed Rounds and ICOs (2020 - 2021)

Solana was launched after a series of private and public token sales in March 2020. The campaign for Solana’s initial coin offering (ICO) was held on the token distribution and trading platform CoinList. In total, 8 million SOL tokens were allocated for the public auction sale on CoinList at an SOL token ICO price of $0.22. The Solana team managed to sell all tokens in a single day for a total haul of $1.76 million.

Recent Round (2021 - now)

June 2021 saw Solana secure a remarkable $314 million in funding from prominent investors such as Andreessen Horowitz and Polychain Capital. This substantial investment underscored the confidence in Solana’s potential to revolutionize blockchain technology. Additionally, an undisclosed corporate round was completed in August 2021, further bolstering Solana’s financial foundation.

Post the Collapse of FTX

The collapse of FTX resulted in a redistribution of their SOL token in the Solana community. Messari’s report disclosed that the FTX Estate had been auctioning off its 41 million locked SOL that it acquired from the Solana Foundation and Solana Labs. It was reported that FTX had sold its SOL holdings to whale buyers including Pantera Capital, Figure Markets, Galaxy Trading, and Neptune Digital at the price ranging $64-$102. The tokens sold are subject to the same unlock schedules as the original purchases by Alameda and FTX.

In a brief summary, Solana’s funding journey highlights the increasing interest and confidence of crypto investors. The continuous influx of capital has enabled Solana and its ecosystem to expand rapidly and remain at the forefront of blockchain innovation.

Highlights and Milestones

In the four years since mainnet launch, Solana has a number of pivotal moments that shaped Solana’s growth and adoption, including:

Solana launched the beta Mainnet in March 2020, marking its official entry into the blockchain ecosystem. It also drew significant interest from developers, users and investors alike.

The launch of user-friendly wallets like Phantom and Solflare has made it easier for users to interact with Solana, enhancing accessibility and user experience.

Despite the fallout from the FTX collapse, Solana has successfully rebuilt its ecosystem and community, demonstrating resilience and adaptability.

Solana has emerged as a leader in the memecoin and celebrity coin trends, showcasing its ability to capture market interest and drive innovation.

These milestones underline Solana’s commitment to scalability, user engagement, and ecosystem expansion.

Blockchain Metrics

2023 is the year of Solana's comeback. Since October 2023, SOL prices have surged around 10x in 6 months. More importantly, Solana's onchain activities explored as thousands of new users flowed into the novel ecosystem.

TPS and Throughput

At present, Solana is consistently clearing ~260 million daily transactions (over 3000 TPS) over the past week with over 90% success rate. Around 170k blocks are produced daily with the average block time being 0.4-0.5s.

Excluding the voting transactions, Solana has over 700 real-time TPS, which is 50x more than that of Ethereum mainnet and 17x more than that of Base chain, the most popular Ethereum layer2 network.

Network Fee/Usage

Onchain active wallets soared to over 880k as more people got interested in the Solana ecosystem. Due to the rise of onchain activities, Solana network fees skyrocketed from 1500 SOL at the beginning of 2024 to 6500 SOL today, where the priority fee ratio has climbed up to 97%, suggesting that people are financially driven to pay more priority fees to speed up their transactions.

In the meantime, Solana has witnessed a rally in gas usage according to Artemis chain comparison. Despite the low transaction fee, over $36 million is spent for gas consumption in the past one month, ranking Solana as the second largest gas consuming blockchain. Amidst the gas usage categories, MEV on Solana takes a decent share of 17%, indicating the boom of onchain finance activities.

USDC Issuance

Solana is also one of the legit blockchains with native USDC issuance. As for now, Solana has a total circulating supply of $2.5 billion USDC, accounting for 7.23% of the total USDC supply across all blockchains.

Circle, a prominent stablecoin issuer, has recently minted $250 million worth of USDC on the Solana blockchain, signaling the boosting liquidity and market optimism.

Staking Rate

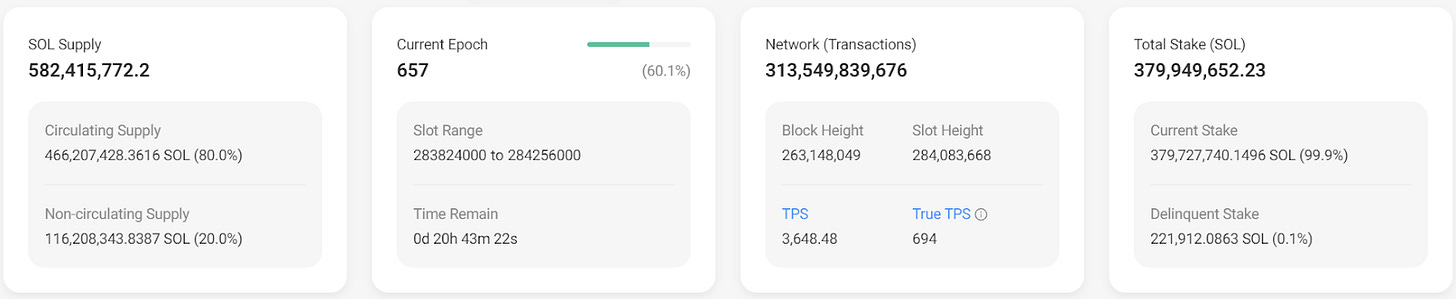

A staking mechanism is utilized to secure the Solana network and Solana is now one of the largest staking blockchains in the world. To date, there are over 380 million SOL tokens staked on the network by around 440k unique wallets across the world. The total value of staking assets surpasses $53 billion at the current SOL price. In contrast, the staking ratio of Ethereum mainnet is around 30% at present.

Developer Cohort

Developers are the backbone of the blockchain ecosystem, playing a crucial role in driving technological advancements, ensuring security, and fostering community growth.

According to Electric Capital's developer reports 2024, Solana’s developer ecosystem grew 600+% since the start of 2021, surpassing 2800 monthly active developers now.

Tokenomics and Emission

As of 17th August 2024, the total supply of SOL is 582 million. Among them, 116 million SOL is held or distributed by Solana Foundation/Labs as locked SOL and 466 million SOL is circulating on the market.

Different from other blockchains, Solana doesn’t have a fixed maximum supply. Instead, it dynamically adjusts based on network activity and validator performance. Solana’s inflation rate is determined by multiple network parameters. The inflation schedule started at 8% emissions and has decreased by 15% every 180 epochs (~1 year) since. This emission reduction schedule has a long-term inflation target of 1.5%. Currently, Solana’s inflation rate sits around 5.168% annually.

To reduce the overall token supply, transaction fees are partially burned (50% of total transaction fee now). The deflationary mechanism helps maintain scarcity and potentially increases SOL’s value over time.

At present, around 170k SOL is produced each epoch as an inflation reward and 5k SOL is generated as block reward to validators. In terms of burning, around 5k SOL is burned to reduce the overall token supply.

It's worth noting that 380 million out of the 582 million SOL (around 66%) is staked and 48 million staked SOL is from locked SOL, which makes the "real" circulating SOL merely 134 million (466 - (380 - 48) = 134 million ). What a cut!

Notable Projects

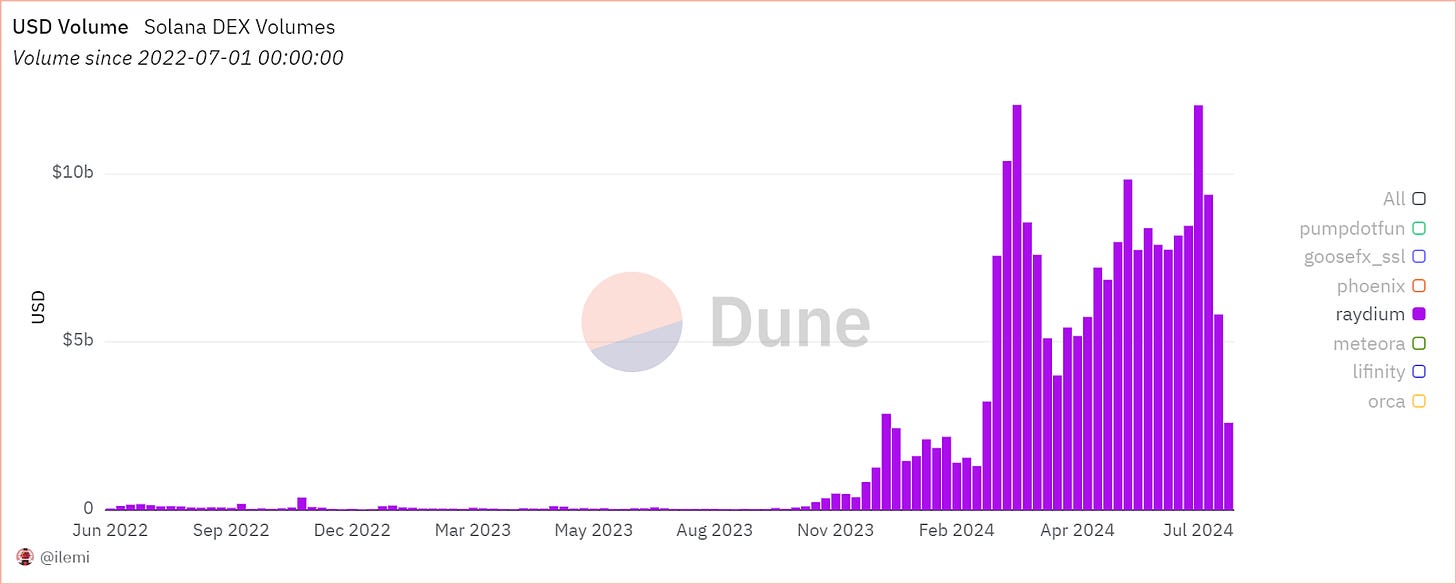

Amidst the surge in SOL price, the Solana ecosystem has taken center stage in the crypto market. In the past week, Solana's weekly DEX volume surpassed $14 billion, overtaking Ethereum in weekly onchain trading volume. In terms of NFT tradings, Solana also surpasses all other chains in 24-hour NFT blockchain user adoption.

In the Solana season, a few notable projects have demonstrated remarkable performance and made huge growth in the last few months, including:

Raydium

Raydium is a decentralized exchange (DEX) on Solana that combines automated market maker (AMM) functionality with order book integration. Due to the popularity of memecoins, Raydium quickly caught on and became the most used DEX for memecoin trading. According to Syndica’s research, Raydium memecoin volume dominance jumped from 25% to 92% in the last seven months.

Currently, Raydium has a 24h trading volume of $1.1 billion, dominating around half of Solana's onchain volume. As Raydium charges a fixed 0.25% fee for each token swap, it prints over $2.5 million trading fees every day and allocates 88% to its liquidity providers and the remaining 12% to its stakers.

Jito Network

Jito network is the liquid staking service for Solana that distributes maximum extractable value (MEV) rewards to holders. The Jito Stake Pool enables users to stake their Solana tokens in exchange for a liquid stake pool token (JitoSOL). As of the latest data, the Total Value Locked (TVL) in the Jito is approximately 12 million SOL ($1.7 billion at current SOL price) with a decent APY of 8.35% for its JitoSOL holders.

In addition, Jito is also a marketplace for blockspace. Put simply, Jito client operates an auction mechanism for blockspace for portions of each Solana block, where Jito assures the inclusion of certain transaction sets known as “bundles.” MEV “searchers” submit these bundles, which are assured onchain execution upon winning a “tip” auction.

The MEV tips on Jito are surging as the Solana onchain activities thrive. On 28th July 2024, Jito harvested an all-time high of over 17k SOL as the validator tips, which would make an incredible annual income of 6.2 million SOL.

JitoSOL is also one of the most popular liquid staking assets on the Solana network. In less than one year, JitoSOL has taken a lion's share of 49% in the Solana liquid staking market, outperforming any other Solana LST assets.

Pump.fun

Pump.fun is a native launchpad platform focused on creating and trading memecoins on the Solana. It simplifies the process of issuing and trading new tokens, making it accessible for both newcomers and experienced users.

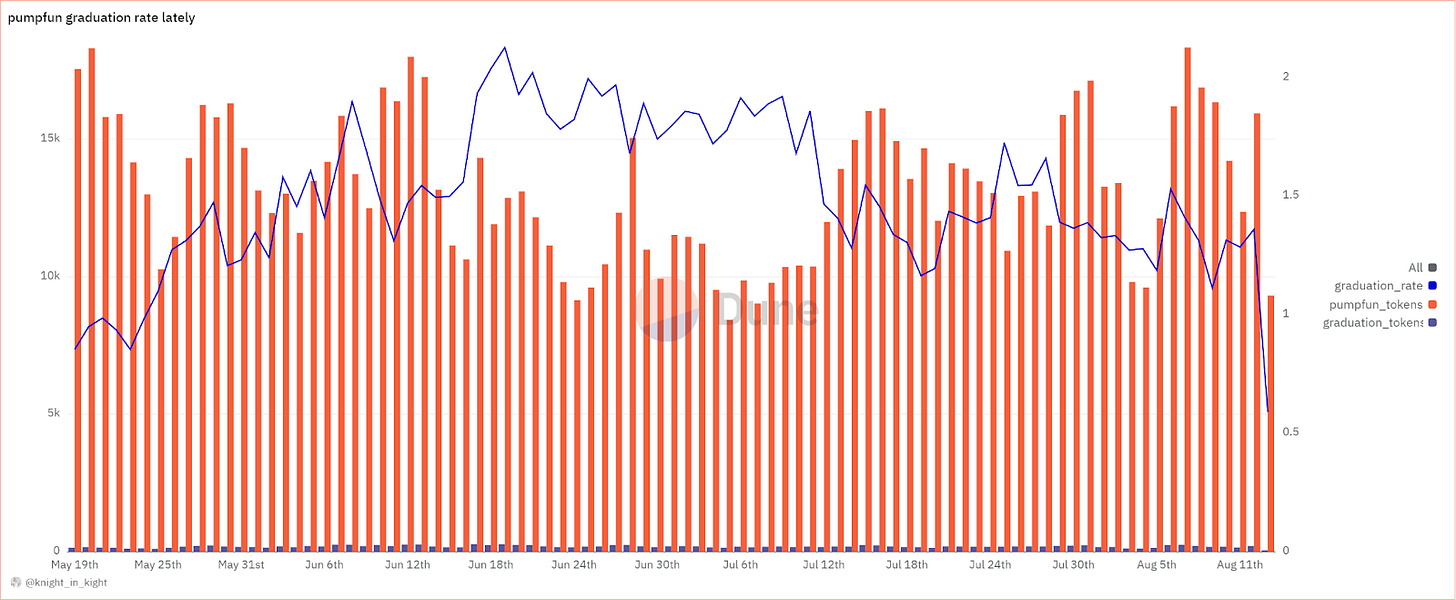

Pump.fun has rapidly gained popularity as memecoins and celebrity coins took off on Solana. Since its launch in January 2024, over 1.8 million tokens have been deployed on Pump.fun. The platform has also captured more than 627K SOL (approximately $96 million at current price) in revenue from the memecoin hype, making it a cash cow despite market volatility.

These native projects bookmark the renaissance of the Solana ecosystem. Additionally, other projects like Jupiter, Sanctum, and hivemapper etc, also showcase the diversity and innovation within the Solana ecosystem.

Real-World Impacts

Solana isn't just a fancy crypto powerhouse, but it's making waves and impacts in the real world, transforming industries faster than you can say "blockchain".

Take payments, for instance: Solana Pay is turning the act of buying your morning latte into a near-magical experience, with transactions so fast and cheap, you might forget you're using crypto at all. In the realm of decentralized physical infrastructure (DePIN), projects like GenesysGo are leveraging Solana's speed to create decentralized cloud storage solutions that could make AWS look old-fashioned. Meanwhile, Solana's foray into mobile with the Solana Mobile Stack and Saga phone is bringing crypto quite literally into the palms of our hands, potentially bridging the gap between Web3 and the billions of smartphone users worldwide.

And let's not forget NFTs – Solana's Metaplex standard and marketplaces like Tensor and Magic Eden have turbo-charged the digital art world, enabling creators to mint and trade NFTs with the ease of posting on social media, but with far more lucrative outcomes. Notably, Metaplex’s cNFT standard has bootstrapped helium mobile to onboard over 100k subscribers.

It's as if Solana took a look at the pain points across various industries and said, "Hold my beer." The consequence? A blockchain that's not just solving existing problems, but opening doors to innovations we haven't even imagined yet. In the Solana ecosystem, crypto adoption isn't just coming – it's already happening.

Challenges and Concerns

Bot Trading

While Solana's technological prowess is impressive, it also has its challenges and potential pitfalls. The ecosystem's efficiency has become a double-edged sword, attracting a surge of bot activity that raises questions about fair access, wash trading and market manipulation. According to the rough estimate of Flip Research, over 93% of the trades (and by extension, fees) on Solana are non-organic and possibly executed by bots. Moreover, around 66% of Solana transactions, especially the memecoin transactions, are reported to be bot trading. In a quick summary, users, organic fees and dex volumes on Solana are all therefore highly inflated, due to the rampant activities of bots. It’s concerning that the growing bot activities may lead to increased network load, heavy spamming and value extraction.

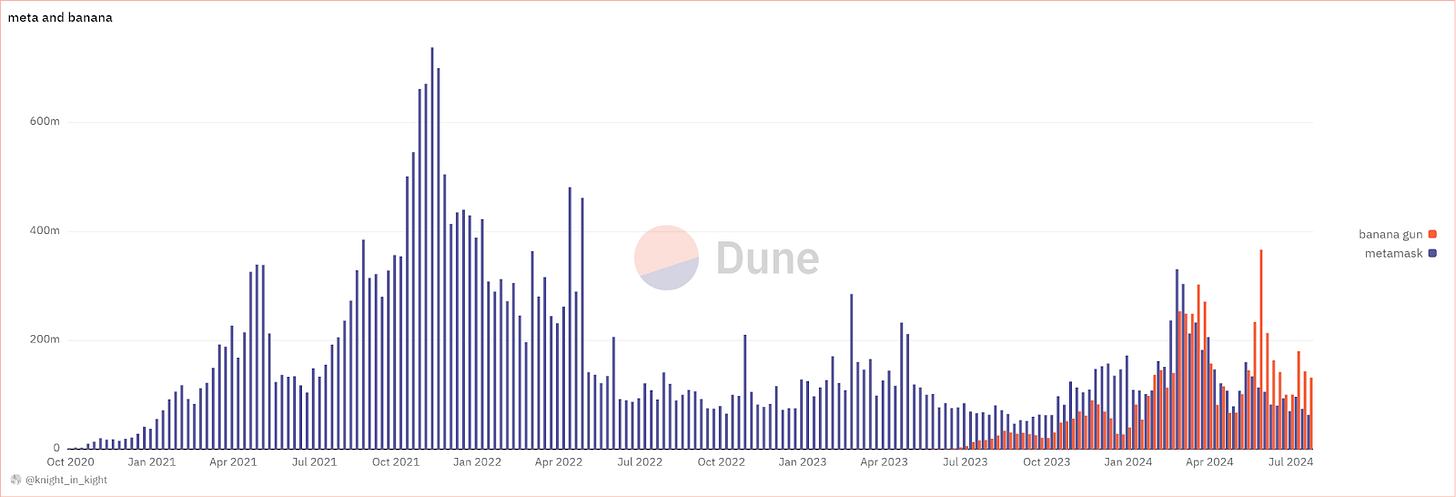

However, it’s also worth pointing out that not all bots are evil and harmful. With the rise of Telegram trading bots, the trading bots are onboarding more and more users due to their user friendly interface and smooth trading experience. In fact, Banana Gun, one of the popular trading bots, has captured a daily volume of over $100 million, surpassing that of Metamask wallet swap.

Another fun fact is that Banana Gun onboards over 5000 new users every week, making it a gateway of new blood into the space. It may sound counterintuitive, but behind the bots, a new wave of users are onboarded in the way we never experienced before.

Memecoin Hype and Value Extraction

Memecoins are thriving on Solana. To some extent, they are the catalyst of making Solana great again. The recent memecoin frenzy, epitomized by the explosive growth of meme tokens like BONK and WIF, has injected significant liquidity into the ecosystem with over $1 billion in trading volume within weeks. The result is that, as Messari’s latest memecoin research revealed, memecoins had taken a dominant role in Solana's DEX trading volume, comprising $192 billion (51%) of the total volume since August 2023.

However, the memecoin mania also introduces huge volatility, rugpulls and significant value extraction in a long term view. Most memecoins end up with a death spiral and late investors suffer great losses. For example, celebrity memecoins were once the most talked topic on podcasts, however, almost all celebrity memecoins had experienced over 80% price freefall. Their followers unfortunately fell into the victims of the catastrophic price plummet.

As the major contributor of memecoin season on Solana, pump.fun has collected over $96 million revenues and facilitated the creation of around 2 million memecoins on Solana. However, only around 1.3% of memecoins can finally graduate from the bonding curve and have a public pool on Raydium, which results in an ultimate PvP game and rugpull race for pump.fun players.

The extraction of value from memecoins on Solana is becoming increasingly worrying. According to 0xngmi, approximately $1 billion has been siphoned off by various beneficiaries, including MEVs, memecoin launchpads, and DEXs.

There’s an emerging trend where the number of coins exceeds the capital required to sustain growth. This raises a critical question: Will we witness a violent collapse that stifles any new developments, or will fresh capital and new participants keep the momentum going? The answer remains uncertain, but the memecoin frenzy is now hanging over Solana users like the Sword of Damocles.

Catalysts Ahead

In the early half of 2024, Solana has achieved great success to onboard hundreds of thousands new players on its path to mass adoption. But if we look ahead, more key catalysts are on the roadmap and poised to drive Solana’s adoption forward in the rest of 2024.

New Migrations and Expansions

Except for the numerous memecoins that migrate to Solana, several notable crypto projects have migrated to or expanded onto Solana. From Helium and Render network to Renzo Protocol, Solana shows a growing appeal and more EVM-native projects try to find their new places in the Solana ecosystem.

These migrations highlight Solana's strengths in performance and cost-efficiency, which are particularly attractive for projects requiring high throughput or frequent microtransactions. The influx of diverse projects has several positive impacts on the whole ecosystem, such as diversification of use cases beyond DeFi and improved liquidity and interoperability within the ecosystem.

As the Solana ecosystem continues to mature, it is becoming an increasingly attractive destination for projects seeking high performance and scalability. More future migrations or expansion to Solana are likely to be witnessed in the following years.

Firedancer

Developed by Jump Crypto, Firedancer is an independent validator client for the Solana blockchain. It aims to enhance the network’s security and efficiency. In an early demonstration broadcast at Breakpoint 2022, the Firedancer client proved itself capable of processing over 1M transactions per second.

Firedancer is expected to be a milestone in Solana history and plays a pivotal role in processing transactions and building blocks on the Solana network. If Firedancer lives up to its promise of processing over 1 million transactions per second, it could revolutionize not just Solana, but the entire blockchain industry. This level of throughput could enable Solana to support applications that are currently infeasible on any blockchain, such as high-frequency trading or real-time global payment systems.

Though the launch day of Firedancer is not decided yet, the Firedancer development seems to be going well. According to CantelopePeel, an engineer of Jump Crypto, the Firedancer client has built its first accepted block on Solana testnet.

Blinks

Blinks on Solana are part of the Solana Actions framework, which simplifies blockchain transactions by turning them into shareable, metadata-rich links. Blinks allow users to perform blockchain transactions directly from various platforms, such as websites, social media, or even messaging apps, without needing to navigate away to a different application. For example, X users can now directly participate in the prediction market through blinks without leaving the X client.

Blinks could be a game-changer for mainstream crypto adoption, potentially becoming the 'HTTP of blockchain interactions'. By simplifying blockchain transactions into shareable, metadata-rich links, Blinks could:

Catalyze a new wave of 'blockchain-native' social media interactions, where sharing value becomes as simple as sharing a link.

Enable seamless integration of crypto payments into e-commerce, potentially disrupting traditional payment processors.

Foster the development of new marketing models where engagement directly translates to value transfer.

Blur the lines between Web2 and Web3, potentially accelerating the transition to a more decentralized internet.

As one of the native innovations on Solana, Blinks are prominent to onboard the next wave of non-crypto users in the Solana ecosystem.

Solana Layer2s

Solana Layer2 solutions aim to further enhance the scalability and efficiency of Solana by offloading some of the transaction processing to secondary layers.

Sonic is the first Solana Layer2 for sovereign games, built with the HyperGrid framework. Sonic aims to provide horizontal scaling for the Solana Virtual Machine (SVM), enabling high-performance gaming applications. Grass is another novel Solana Layer2 and designed to enhance AI data processing on Solana. It records metadata to verify data sources, helping to combat data pollution and support the data layer of open-source AI.

The development of Layer2 solutions on Solana, such as Sonic for gaming and Grass for AI data processing, could redefine the blockchain scaling debate. Unlike Ethereum, where Layer2s emerged out of necessity due to network congestion, Solana's Layer2s are proactively expanding into specialized use cases. The difference may accelerate the innovations on Solana in specific sectors like AI and DEPIN, as these Layer2s provide tailored environments for development.

Conclusion

As Solana continues its journey, it stands at the forefront of blockchain innovation. The ecosystem's rapid growth demonstrates its potential to address long-standing blockchain challenges. However, the road to success is not without complexities and obstacles. The rise of bot trading, memecoin speculation and value extraction present both opportunities and risks, highlighting the need for careful navigation as the platform evolves.

Looking ahead, Solana's roadmap is filled with promising developments. From the game-changing Firedancer client to the user-friendly Blinks framework, these initiatives could further solidify Solana's position as a leading blockchain ecosystem. As more projects migrate to or expand onto Solana, the network's versatility and efficiency continue to attract developers and users alike.

Ultimately, Solana's journey exemplifies the dynamic nature of the blockchain space. Its ability to balance technological innovation with real-world application will be crucial in determining its long-term impact. As the crypto world watches closely, Solana's ongoing evolution may well set new standards for what's possible in decentralized technology, potentially reshaping the digital future in ways we're only beginning to imagine.